By Thomas Waterfield

While the world’s attention was on the BRICS Summit in August, a new development in payments was beginning to emerge — BRICS Pay. There were hints way back in 2019, and recently, the first BRICS Pay payment occurred in a Moscow store.

The demo included a South African wine purchase via the BRICS Pay app, marking a notable advancement in payments and yet another possible shift from the traditional finance world.

According to the BRICS Pay website, the app ‘aims to facilitate digital transactions among BRICS countries, enabling secure, seamless payments in local currency, reducing the cost and complexity of international payments.

With the payment app, they aim to boost trade and financial exchanges between its members through its new, more straightforward payment service, focusing on using their national currencies instead of the US dollar. BRICS Pay aims to simplify cross-border payments, using an integrated cloud platform that connects with the national payment systems of BRICS countries. While not a replacement for giants like SWIFT, it’s a nod towards boosting trade in local currencies among BRICS nations, a sentiment shared by South Africa’s finance minister.

SWIFT is a global messaging network used by banks and other financial institutions to securely transmit information and instructions for financial transactions, such as money transfers.

Has BRICS resolved cross-border payment issues?

While numerous countries are advancing in account-to-account payments and embracing open finance, cross-border payments continue to present significant regulatory challenges.

With Central Bank Digital Currencies (CBDCs) joining the fray to tackle cross-border payment challenges, BRICS Pay has quietly created a decentralised, multi-currency digital payment system under the leadership of BRICS nations. This development is integral to wider debates on minimising dollar dependence, drawing focus to digital currencies as emerging forces that could reshape the landscape of traditional financial power.

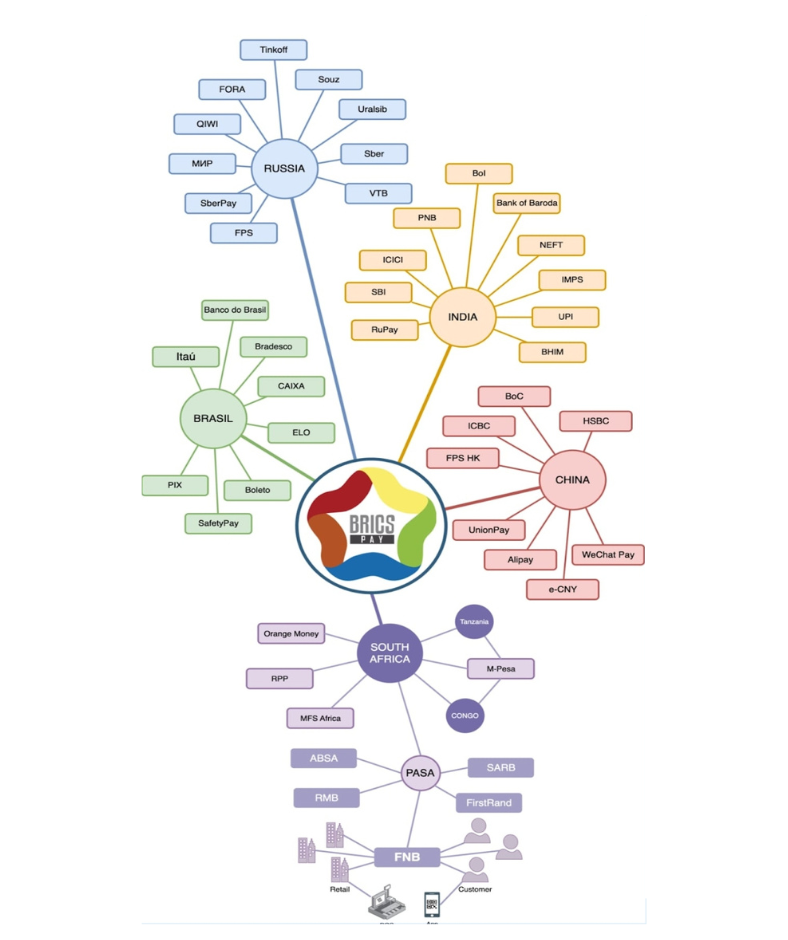

According to the BRICS Pay website, BRICS PAY is a digital payments platform that is being jointly developed by the member countries of the BRICS (Brazil, Russia, India, China, and South Africa) economic alliance. BRICS PAY aims to enable digital payments between the different countries in BRICS, allowing businesses and consumers to securely and seamlessly make and receive payments in their local currency. The platform is designed to reduce the cost and complexity of international payments, as well as providing a secure and reliable way to pay for goods and services.

BRICS Pay offers a functionality where users can connect their credit or debit cards to digital wallets for mobile transactions. This innovation streamlines the payment process and enhances user convenience, positioning BRICS Pay as a user-friendly option for cross-border financial dealings among BRICS countries.

Through the use of open APIs, the BRICS PAY system will ensure that customers have access to their accounts, no matter what payment system they use — funds can move between systems faster and more securely.

Power of Blockchain

Harnessing the power of blockchain, BRICS Pay seamlessly merges national payment systems into a singular cloud platform, streamlining cross-border transactions. By employing blockchain and tokenized assets, it not only bolsters security but positions itself as a futuristic solution.

Blockchain is a decentralised technology that securely and transparently records transactions. Each transaction block is linked to the previous one, forming a chain. In the context of BRICS Pay, blockchain aids in transparent, secure, and streamlined cross-border transactions, reducing the need for multiple intermediaries, which could lower transaction costs and enhance efficiency. In short, transactions take place across many computers in a way that is secure, transparent, and unable to be tampered with.

This venture catalyses a shift towards embracing indigenous currencies, hinting at a financial autonomy that might rival traditional frameworks. Institutions like the UK’s Standard Chartered Bank are weaving it into their digital payment infrastructures to bridge connections with BRICS regions. The important caveat is that unlike CBDCs or cryptocurrencies, BRICS Pay champions the individual currencies of BRICS nations.

With the State Bank of India and Russia’s Sberbank rolling out BRICS Pay-centric mobile applications, it’s clear that this isn’t merely about cross-border transactions but also fostering a road that may pave the way for microfinance, thus catalysing real-time financial engagements and bolstering trade relations among member states.

BRICS Pay could even prompt the UK, US, and Europe to modernise their own systems a lot faster by offering a model for using blockchain in cross-border payments. It could challenge traditional systems like SWIFT, which likely won’t happen for a long time but it’s all leading to a more varied global financial scene.

How it works

Projected structure outline on the example of South Africa

- When someone sends money through BRICS Pay, the money is changed into a digital currency and is then sent to the receiver’s country.

- Once it reaches the receiver’s country, the digital money is handled by either a private bank or the country’s central bank.

- The exact method of how the receiver will get the money is decided by each country.

- This setup is to ensure that the transaction is secure and properly managed at both ends — sending and receiving.

– In the next article in this series, we’ll dive into cross-border payments and how BRICS Pay seems to solve the related challenges.